この投稿は、Finmath for Fintechコースの一部として、2つの短いビデオ講義「変動レートとベンチマーク」と「インタレストスワップ」の改訂版です。

#1。変動レートとベンチマーク

主な質問から始めましょう:銀行はどこからお金を手に入れますか?答えは表面にあります:彼らは他の銀行から借ります。これは銀行間貸出市場または単に銀行間市場と呼ばれています。大規模な組織では、原則として、短期間(1日、1週間、1か月)で多額の金額を支払います。たとえば、ロンドンのような大規模な投資銀行にいるとします。今日は何パーセント借りられますか?

これは、約30年前に英国銀行協会が尋ね始めた問題です。彼らは主要なプレーヤーからの回答の収集、最小から最大へのソート、マージンの破棄、および平均のカウントを開始しました。これはLIBOR-ロンドンインターバンクオファーレートと呼ばれます。 LIBORは5つの通貨(ユーロ、英ポンド、ドル、スイスフラン、円)と7つのテノール(ちなみに、この場合、テノールはオペラの声ではなく、そのような期間)で公開されています-1日、7日、1ヶ月、2ヶ月、3ヶ月、6ヶ月、12ヶ月。セブンテナーは、週の7日間のようなものです。合計すると、毎日稼働する35個の値が取得されます。

LIBOR , . , , LIBOR , .

LIBORは、ベンチマークとも呼ばれます。ご存知のように、ベンチマークは参照の一部です。この場合、ベンチマークは金利であり、これは市場の感情、現在の経済状況およびその他の要因を反映しています。

2018年、LIBORと同様のベンチマークEURIBORは合計370兆ドルを超える契約を獲得しました。そう、13個のゼロとの合計はたくさんあります。これらのコントラクトについては少し後で説明しますが、今度はEURIBORを見てみましょう。

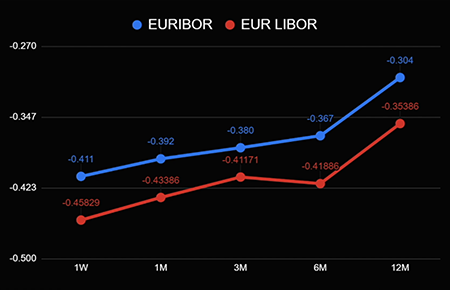

これは、ユーロインターバンクが提供するレート、つまりユーロゾーンで形成されるレートだとすでにご存じだと思います。ここで注意深い読者は尋ねます:「LIBORのユーロレートとEURIBORのユーロレートの間に違いはありますか?」もちろん、違いはあります。イラストを見てみましょう。

グラフは、曲線が類似しているがまだ異なることを示しています。これは1日のランダムな効果ではなく、2つの市場で形成される2つのレートの根本的な違いです。

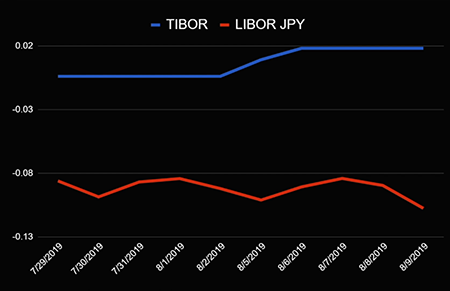

それでは、東へ約1万キロ早送りして、東京の街に身を置きましょう。そこで、TIBOR-東京インターバンクオファードレートと呼ばれるレートが形成されます。ここでも、円のLIBORと円のTIBORを比較して、それらが異なるかどうかを確認できます。

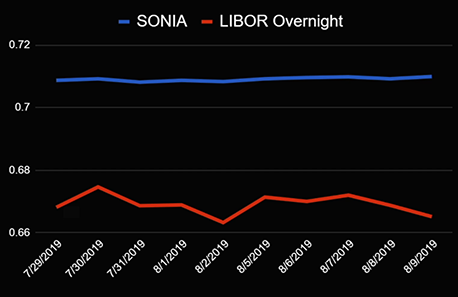

私たちが見たものからどのような結論を導き出しますか?各市場は独自のレートを公開しています。ロンドンには独自のレートがあり、ヨーロッパゾーンには独自のレートがあり、日本にも独自のレートがあります。しかし、ロンドンに戻りましょう。そこにはソニア(Sterling Overnight Interbank Average Rate)と呼ばれる別のレートがあることがわかります。それは銀行間英ポンド市場における平均夜間貸出金利を示しています。 LIBORにも一泊料金があることに注意してください。グラフで比較してみましょう。

これらは同じ都市で1つの通貨、1つのテナーで発行される賭けですが、違いがあります。理由は何ですか?

LIBORは伝説的な金利です。膨大な数のコントラクトが関連付けられているという事実(覚えていれば、これはゼロが13ある量です)だけでなく、ベンチマーク操作の事実でも知られています。2008年以降、LIBORパネルのメンバー、つまり調査に参加し、平均化と公開のための値を規制当局に提供した銀行は、意図的にレートを過大評価または低下させたことが判明しました。スキャンダルは2012年に発生し、多くの銀行にとって数百万ドルの罰金に終わりました(一部の罰金は10億ユーロに達しました)。市場は、LIBORで何かをする必要があることに気づきました。

外部の影響とLIBORの代替に対する保護

最初に変更されたのは、計算方法です。スキャンダルの前は、LIBORは単に算術平均と見なされていました。どういうわけかLIBORに影響を与えたいと想像してください。 16の銀行が調査に参加しています。つまり、最大の4つの値と最小の4つの値が破棄され、残りの8つの値の平均が計算されます。 「公平な」LIBOR値を+ 0.08%変更し、送信された値が最大の25%および最小の25%に該当しない場合、公式のLIBOR値は+ 0.08%/ 8 = +0.01だけ変更されます。 %。

発見された操作の後、レートは異なる方法で検討されました。3層からなる、いわゆるウォーターフォールモデルが登場。最初のレイヤーでは、トランザクションを説明します-レベル1:トランザクションベース。次のレイヤーでは、市場の動きと過去の取引を考慮します-レベル2:取引派生。そして、3番目のレイヤーでのみ、専門家の判断、つまりレベル3の専門家の判断を追加できます。したがって、LIBORは異なる方法で検討され始め、市場は代替案について考え始めました。

SONIA-ポンドのオーバーナイトレート-はまさにそのような選択肢です。計算方法が異なります。

SONIAは、インターバンク市場での完了したトランザクションの平均です。つまり、第1に、すべての市場参加者を考慮に入れ、第2に、専門家の推定ではなくトランザクションに基づいています。したがって、これは市場のより客観的な評価です。また、上記の操作に対して耐性があります。

ユーロ圏におけるSONIAの類似物はEURONIAであり、ロシアではRUONIAです。ロシアのLIBORの類似物はMosPrimeレートです。興味があれば、この値を使用して、モスクワで銀行が貸している金利を調べることができます。

小計

そのため、銀行間で貸し付けを行うインターバンク市場があることがわかりました。通常、このお金は変動金利で与えられます。これらのレートは毎日新しく、LIBOR、TIBOR、EURIBOR、MosPrime Rateなどのベンチマークをベンチマークと呼んでいます。これらのベンチマーク金利は、それらが生成される場所(国、都市)と計算方法が異なります(たとえば、LIBORはロンドンで主要市場参加者の調査によって計算され、EURONIAまたはRUONIAレートはすべてのトランザクションの平均として計算されます。特定の日)。LIBORとEURIBORには、依然として膨大な数の契約があります(昨年だけでも370兆を超える)。これらの契約とは何か、以下をお読みください。

#2。金利スワップ

したがって、2つの世界があります。 1つ目は、変動金利で運営される銀行業界です。もう1つは、固定金利で生活するノンバンキングの世界です。銀行に来て、次のように質問すると、同意します。「私のお金を何パーセント入れますか?」-「LIBOR + 50 bps(ベーシスポイント)」と回答されます。それはたくさんですか、それとも少しですか?私が銀行家で、私のお金はLIBOR + 50ベーシスポイントに置かれると彼らに言われたら、私はこう言います。しかし、これは何の意味もありません。「3%」と聞くと、はるかにはっきりします。明らかに、銀行には3%を理解する個人と、「LIBOR + 50 bps」という表現を理解する顧客の両方がいます。

, , interest rate swap (IRS). - .

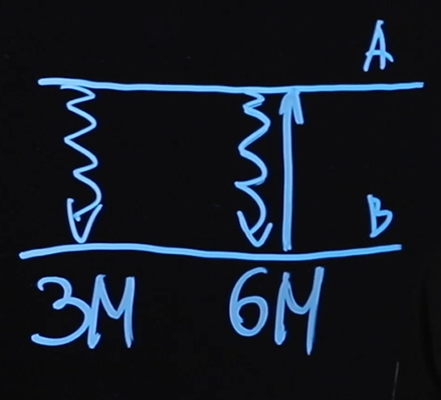

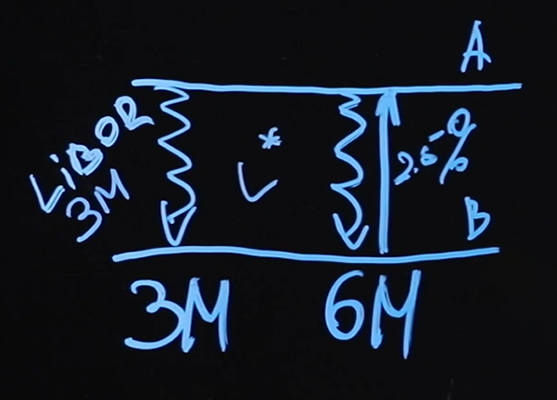

契約がどのように機能するか見てみましょう。契約は、A側とB側の2者間で締結されます。A側はフローティングレッグを支払い、B側は固定レッグを支払います。彼らがこれを行う頻度は、契約のパラメーターによって異なります。

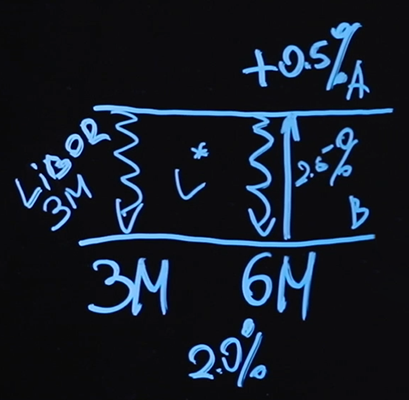

この図では、3か月ごとにサイドAがサイドBに変動する「レッグ」を支払い、6か月ごとにサイドBがサイドAに固定「レッグ」を支払うことを示しています。 2.5%と言う)-これは金利スワップの価格になります。

これらの浮遊する「脚」で何が起こっていますか?ここでは、LIBORが支払われます。おそらく3か月です。

最初の変動支払いは、今日のLIBORレートで3ヶ月で行われます。 3か月後、新しいLIBOR値がわかります。この値は、6か月の時点でいくら支払われるかを決定します。

結果として誰が黒くなるのでしょうか?フローティングレッグでは最初に2.2%を支払い、次に2.6%を支払い、固定レッグでは再び2.5%を得るとすると、合計で+ 0.1%* N =-(2、 2%+ 2.6%)/ 2 * N + 2.5%*N。Nは契約金額です。このような支払いスキームとの契約はバニラスワップと呼ばれます(ご想像のとおり、スパイスとして使用されているバニラとは関係ありません)。

このタイプの契約はいくつ実行されていますか?統計によると、2019年の前半には約969,915件のトランザクションがあり、合計で38兆ドルに上ります。つまり、1つのトランザクションの量は8100万ドルで、これは印象的です。

次に、価格のような興味深い質問に移りましょう。そのような契約の費用はいくらですか?これを公正価格と呼びます。取引時のフローティングレッグと固定レッグは同じであるため、価格は「公正」です。

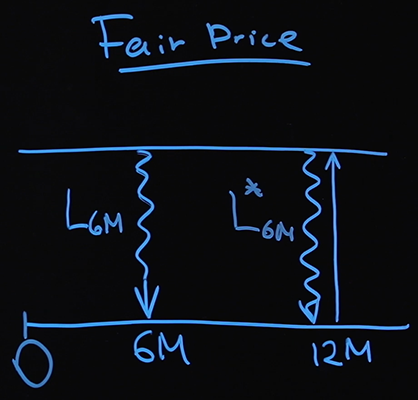

3回の支払いがある些細なケースを考えてみましょう。2回は6か月ごとに変動し、1回は12か月ごとに固定されます。もちろん、実際の契約は私たちのスキームよりもはるかに複雑であり、通常は数十回の支払いで構成されています。

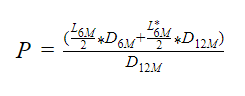

変動支払いの値がどこから来たかを思い出してみましょう。それで、本日契約に合意しました。 LIBOR値が公開されているページを開き、それらを確認します。今日、LIBOR 6M L 6M = 2.2%としましょう。これで、一方の当事者が他方の当事者に6か月で支払う金額が正確にわかります。 6か月後、もう一度LIBOR 6M-L * 6Mを調べます。固定レッグでは、Pの特定のパーセンテージが支払われ、これを計算します。

トランザクションの時点で、2つの変動支払または1つの固定支払を受け取るかどうかに違いはないと両当事者は信じていることを思い出してください。これは、以下を意味します

。PV 固定 = PV フロート

固定脚と浮動脚のPV(現在値)を書き留めましょう。 12か月の時点で、金利に契約金額Nが掛けられ、割引係数が掛けられます。

PV Fixed = P * N * D 12m

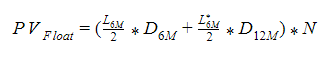

次に、PV Floatを書き留めます。違いは1つの用語になります。

LIBOR 6Mが2で割られるのはなぜですか? LIBORは年率で示されます。この例では、変動する「レッグ」は6か月ごとに支払われます。年率を2で割るのは当然です。

「適正価格」の意味を見つけることは難しくありません。

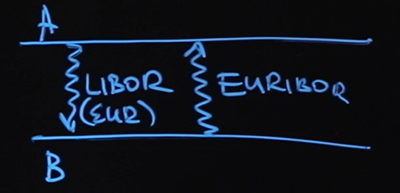

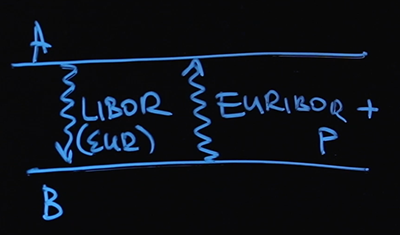

どういうわけかLIBOR値を知る必要があります。 Webサイトで現在の値を確認できますが、このパラメーターの値を6か月でどこで取得できますか?割引率は、よく知られた公式では説明せず、個別に書き留めます。変動支払いが依存するLIBOR値と割引係数の計算方法の間に明確な線を引きたいと思います。 LIBORのカーブと割引用のカーブの2つのカーブが必要です。多くの教科書では、たとえば、「LIBORで割引します」または「割引係数は…(LIBORを含む一部の式)」などのフレーズに出くわします。キャッチは何ですか?最も単純なバニラスワップに加えて(ところで、なぜ「バニラ」であるかという質問への答えは、「バニラアイスクリーム以外に何も単純なものはないから」のように聞こえます)、一方ではフローティング「レッグ」があり、もう一方では固定されています。当事者がフローティングレッグのみを交換するスワップがあります。たとえば、サイドAとサイドBがあります。一方はLIBORを支払い、もう一方はEURIBORを支払います。この契約は変動変動金利スワップと呼ばれます。

LIBORがユーロである必要があることは明らかです(ちなみに、一方の当事者がLIBOR USDを支払う契約があり、もう一方の当事者-LIBOR EUR-これはクロスカレンシーベーシススワップです)。教科書の推奨事項に従い、LIBOR割引係数を使用すると、実際には2つのレートが同じ意味になります。 1つはロンドンで形成されている変動、もう1つはユーロ圏で形成されている変動です。そして、なぜEURIBORよりもLIBORを信頼すべきなのかは、はっきりしていません。ちなみに、この場合、スワップ価格はEURIBORに追加する小さな割合になります。

この場合、変動金利をベンチマークとして使用し、それを割り引くことはあまり正しくないことが明らかになります。したがって、次の問題が発生します。この特定のスワップでは、LIBOR曲線、EURIBOR曲線を計算し、割引曲線を見つける必要があります。割引曲線は、将来から現在に支払を転送するための割引係数を計算するための曲線です。

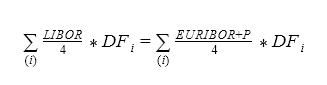

フローティングフローティングIRSの「公正価格」はどのように計算しますか?アプローチはまったく同じです。一方では、LIBORを4で除算します(3か月は年間レートの4分の1であるため)。これには、割引係数を掛ける必要があります。これは、EURIBORに同じ価格Pを4で割った値にすべて割引係数を掛けた値に等しくなります。すべての支払いについて合計が行われます。

この方程式から、Pを見つけるのは簡単です。これは、Floating-Floating IRSの「適正価格」です。

この例が興味深いのはなぜですか?彼は、LIBOR曲線、EURIBOR曲線、および割引曲線の3つの曲線が必要であると語っています。曲線をプロットするための基本的な方法は同じです。割引曲線の例で少し後で見ていきます。とりあえずまとめましょう。

スワップ合計

金利スワップとは何かを学びました。これは、2つのパーティが関与する製品です。1つは固定レッグを支払い、もう1つはフローティングレッグを支払います。これは最も簡単なバニラスワップです。また、両当事者が変動する「レッグ」(変動-変動スワップ)を支払う状況もあります。

2020年初頭には、最も単純なバニラスワップだけで50万以上のトランザクションが完了しました。各トランザクションの平均ボリュームはほぼ1億ドルです。また、スワップの「公正価格」の計算方法も学びました。変動レッグのPVは固定レッグのPVと同じであると仮定して計算しました。この価格フェアは、トランザクションのすべての参加者に適しているため、この価格フェアと呼びました。変動変動スワップの例を使用して、変動金利のカーブと割引のカーブのいくつかのカーブを作成する必要がある場合があることに気付きました。次のパートでは、割引曲線を作成する方法について説明します。

私はあなたが変動金利のトピックにもはや「浮かぶ」ことなく、金利スワップの中でバニラを見つけることができることを願っています。

このシリーズの他の記事:

-金額、利息の種類、割引、先物レート。オタクのための教育プログラム、パート1

- 債券:クーポンとゼロクーポン、利回り計算。オタクのための教育プログラム、パート2

- 債券:リスク評価と使用例。オタクのための教育プログラム、パート3